Categories

Recent Posts

- Southern Cameroons: sharp rise in casualties linked to improvised explosive devices

- Sonara turns to Dangote for funding, fuel supply as debt pressures mount

- Football: Bamboutos Mbouda arrives at stadium with 8 players, no technical staff

- Congo-Kinshasa: More than 200 killed in coltan mine collapse

- Fela Kuti is first African musician honoured with Grammys Lifetime Achievement award

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

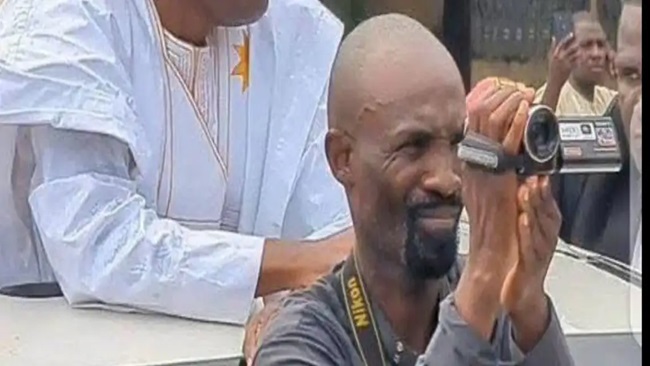

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful  Paul Biya: the clock is ticking—not on his power, but on his place in history

Paul Biya: the clock is ticking—not on his power, but on his place in history  Yaoundé awaits Biya’s new cabinet amid hope and skepticism

Yaoundé awaits Biya’s new cabinet amid hope and skepticism  Issa Tchiroma Bakary is Cameroon Concord Person of the Year

Issa Tchiroma Bakary is Cameroon Concord Person of the Year  Southern Cameroons: Security situation worsening

Southern Cameroons: Security situation worsening

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Southern Cameroons: sharp rise in casualties linked to improvised explosive devices

-

Sonara turns to Dangote for funding, fuel supply as debt pressures mount

-

Football: Bamboutos Mbouda arrives at stadium with 8 players, no technical staff

-

Congo-Kinshasa: More than 200 killed in coltan mine collapse

-

Fela Kuti is first African musician honoured with Grammys Lifetime Achievement award

-

South Africa and Israel expel envoys in deepening feud

-

US: Former CNN host Don Lemon arrested after anti-ICE protests

© Cameroon Concord News 2026

14, August 2019

African Americans lack proper access to US banks 0

Many black people in the United States have difficulty saving money partly because they lack access to traditional banking services, contributing to the growing racial wealth gap in the US, a new study has found.

Many African Americans depend on more expensive alternative financial services like check-cashing counters since there are fewer banks in non-white neighborhoods, according to the study published on Tuesday by McKinsey & Co.

Increasing access to basic banking services, like checking and savings accounts, could save individual black Americans up to $40,000 over their lifetime, the report found.

“Black families are being underserved and overcharged by institutions that can provide the best channels for saving,” said the report authored by McKinsey partners Shelley Stewart and Jason Wright.

In majority-white communities, there are an average of 41 banks and financial institutions for every 100,000 people, compared with 27 in neighborhoods that are majority non-white, the study said.

However, more expensive alternative financial services like payday lending are more readily available in black neighborhoods, the report said.

Additionally, banks in black communities typically require higher account balances to avoid service fees, the study said.

The US racial wealth gap has expanded significantly over the last two decades, with the wealth of the average white family growing 10 times higher than the average wealth of a black family, according to government data.

The white household had a net worth of $171,000 while average black and Hispanic households had a median net worth of $17,600 and $20,700 respectively.

“When you bridge that gap, the money is not just going to black pockets, it’s going to everyone’s pockets,” Wright told Reuters.

America’s racial income inequality and corporate greed has become a focus of the 2020 Democratic presidential candidates.

Critics say the tax policies of US President Donald Trump has funneled vast amounts of money to the wealthiest Americans while offering only modest benefits to lower income taxpayers.

Source: Presstv