Categories

Recent Posts

- Norway’s former PM charged with gross corruption over Epstein links

- Southern Cameroons Crisis: Norway extends pre-trial detention of Ayaba Cho

- Yaoundé: Biya delays elections once again

- Biya’s message to the Youth on the 60th edition of the National Youth Day

- Southern Cameroons Crisis: 5 killed in clashes in Ntumbaw

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

Biya’s message to the Youth on the 60th edition of the National Youth Day

Biya’s message to the Youth on the 60th edition of the National Youth Day  How Cameroon pays the price for disrespecting contracts

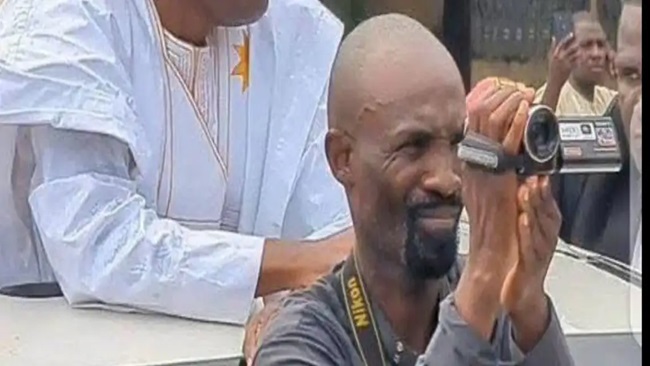

How Cameroon pays the price for disrespecting contracts  Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful  Paul Biya: the clock is ticking—not on his power, but on his place in history

Paul Biya: the clock is ticking—not on his power, but on his place in history  Yaoundé awaits Biya’s new cabinet amid hope and skepticism

Yaoundé awaits Biya’s new cabinet amid hope and skepticism

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Norway’s former PM charged with gross corruption over Epstein links

-

Southern Cameroons Crisis: Norway extends pre-trial detention of Ayaba Cho

-

Yaoundé: Biya delays elections once again

-

Biya’s message to the Youth on the 60th edition of the National Youth Day

-

Southern Cameroons Crisis: 5 killed in clashes in Ntumbaw

-

How Cameroon pays the price for disrespecting contracts

-

Yaoundé: Security strains, political tensions cloud potential papal visit

© Cameroon Concord News 2026

18, December 2024

BEAC increases liquidity injection to meet bank demand 0

The Bank of Central African States (BEAC) conducted a new liquidity injection operation for commercial banks on December 17. This time, the central bank offered CFA220 billion, a rise of CFA60 billion compared to the previous operations on December 3 and December 10.

This increase in liquidity follows a prior reduction of 50%, when the offer dropped from CFA320 billion to CFA160 billion between late November and early December. The adjustment comes amid a renewed interest from banks in BEAC’s refinancing operations. For example, on December 3, the BEAC offered CFA160 billion, but the banks requested CFA224.8 billion. Similarly, on December 10, the entire CFA160 billion made available was taken up, yet not all banks could meet their financing needs, which totaled CFA162.8 billion.

This renewed interest in the central bank’s refinancing offers in December may be linked to increased demand for bank loans. According to banking officials, the year-end holiday season, a time of high consumer spending, often drives up demand for credit in commercial banks.

Source: Business in Cameroon