Categories

Recent Posts

- Victoria United Vs PWD Bamenda: FECAFOOT suspends five match officials over controversial refereeing

- Dollar Bonds: The biggest risk is what Cameroon looks like post Biya

- CPDM Crime Syndicate: Coach Sacked by Eto’o receives salary, AFCON bonus

- Football: Senegalese national killed in Morocco after AFCON final

- Football: Mbeumo hails Manchester United manager Michael Carrick

Archives

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

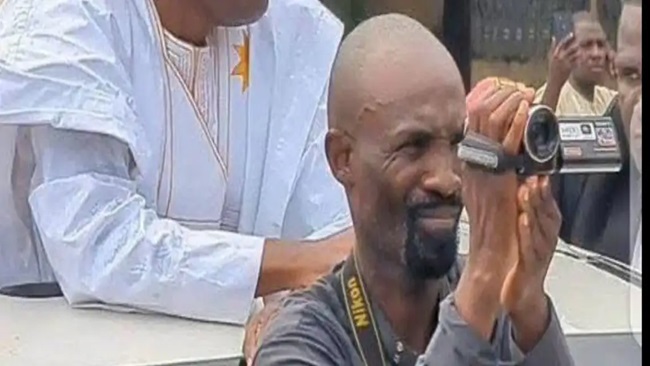

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful  Paul Biya: the clock is ticking—not on his power, but on his place in history

Paul Biya: the clock is ticking—not on his power, but on his place in history  Yaoundé awaits Biya’s new cabinet amid hope and skepticism

Yaoundé awaits Biya’s new cabinet amid hope and skepticism  Issa Tchiroma Bakary is Cameroon Concord Person of the Year

Issa Tchiroma Bakary is Cameroon Concord Person of the Year  Southern Cameroons: Security situation worsening

Southern Cameroons: Security situation worsening

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Victoria United Vs PWD Bamenda: FECAFOOT suspends five match officials over controversial refereeing

-

Dollar Bonds: The biggest risk is what Cameroon looks like post Biya

-

CPDM Crime Syndicate: Coach Sacked by Eto’o receives salary, AFCON bonus

-

Football: Senegalese national killed in Morocco after AFCON final

-

Football: Mbeumo hails Manchester United manager Michael Carrick

-

Southern Cameroons Crisis: UN situation report

-

Iran chief commander says ‘hands on trigger’ against any US and Israel miscalculation

© Cameroon Concord News 2026

27, January 2026

Dollar Bonds: The biggest risk is what Cameroon looks like post Biya 0

Cameroon became the second African nation in less than a week to sell dollar bonds, as frontier markets take advantage of risk-on sentiment to raise funds.

The central African nation priced a $750 million five-year bond at a yield of 10.125%, according to a person familiar with the matter. That compares with a yield of 10.75% on a seven-year dollar note it issued in 2024, when the country last went to market.

Cameroon is rated B-, six levels into junk, by S&P Global Ratings — the same as Nigeria, Pakistan and Angola.

Emerging markets are benefiting from investors shunning the US as geopolitical tensions rise and the independence of the Federal Reserve remains a concern. Risk premia of African frontier markets from Mozambique to Gabon have narrowed to levels below 1,000 basis points over US Treasuries in recent days, prompting nations on the continent and elsewhere to raise foreign-currency-denominated debt.

With conditions having shifted since the last time it came to market, Cameroon should have been in a “position to issue in the single digits,” according to Leo Morawiecki, an emerging-markets analyst at Abrdn Investments in London.

“The biggest risk is what Cameroon looks like post Biya,” he said in reference to the nation’s 92-year-old leader Paul Biya, who won an eighth term in October. “And its very difficult to price that into the bonds as getting a grip on Cameroonian politics is extremely difficult.”

The nation’s $550 million dollar bond due 2031 added 0.27 cents on the dollar Tuesday to 100.80 cents, pushing the yield lower by 6 basis points to 9.31%.

Benin last week sold a $500 million seven-year note at a yield of about 6.2% and an inaugural dollar-denominated sukuk. Ecuador sold $4 billion of bonds on Monday, its largest-ever issuance, in a return to global credit markets after restructuring its debt in 2020. The Democratic Republic of Congo plans a debut $750 million offering in April, the country’s finance minister told Bloomberg last week.

Seasoned eurobond issuers in Africa, such as Ivory Coast and Benin, are unlikely to care that other countries are coming to market given their years of experience, Morawiecki said. “But it likely does have a bigger impact on inaugural issuers such as DRC that look for signs of investor confidence in Africa.”

The continent’s average sovereign-risk premium over US Treasuries fell to the lowest since 2018 this month, and stood at 326 basis points on a closing basis on Monday, according to a a JPMorgan Chase & Co. index.

Source: Bloomberg