Categories

Recent Posts

- Football: Bamboutos Mbouda arrives at stadium with 8 players, no technical staff

- Congo-Kinshasa: More than 200 killed in coltan mine collapse

- Fela Kuti is first African musician honoured with Grammys Lifetime Achievement award

- South Africa and Israel expel envoys in deepening feud

- US: Former CNN host Don Lemon arrested after anti-ICE protests

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

Featured

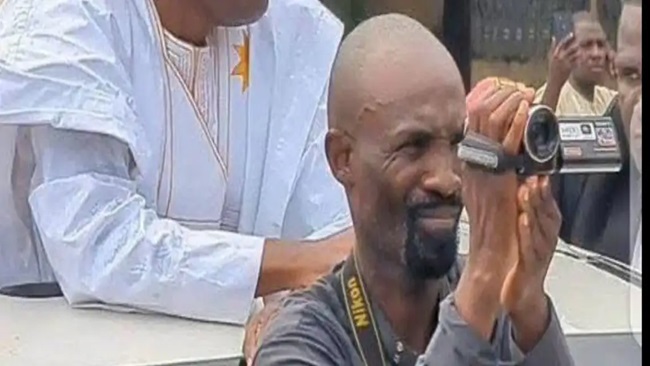

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful

Arrest of Issa Tchiroma’s photographer: shameful, disgusting and disgraceful  Paul Biya: the clock is ticking—not on his power, but on his place in history

Paul Biya: the clock is ticking—not on his power, but on his place in history  Yaoundé awaits Biya’s new cabinet amid hope and skepticism

Yaoundé awaits Biya’s new cabinet amid hope and skepticism  Issa Tchiroma Bakary is Cameroon Concord Person of the Year

Issa Tchiroma Bakary is Cameroon Concord Person of the Year  Southern Cameroons: Security situation worsening

Southern Cameroons: Security situation worsening

Most Commented Posts

4 Anglophone detainees killed in Yaounde

4 Anglophone detainees killed in Yaounde

18 comments Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

Chantal Biya says she will return to Cameroon if General Ivo Yenwo, Martin Belinga Eboutou and Ferdinand Ngoh Ngoh are sacked

13 comments The Anglophone Problem – When Facts don’t Lie

The Anglophone Problem – When Facts don’t Lie

12 comments Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

Anglophone Nationalism: Barrister Eyambe says “hidden plans are at work”

12 comments Largest wave of arrest by BIR in Bamenda

Largest wave of arrest by BIR in Bamenda

10 comments

Latest Tweets

Featured

-

Football: Bamboutos Mbouda arrives at stadium with 8 players, no technical staff

-

Congo-Kinshasa: More than 200 killed in coltan mine collapse

-

Fela Kuti is first African musician honoured with Grammys Lifetime Achievement award

-

South Africa and Israel expel envoys in deepening feud

-

US: Former CNN host Don Lemon arrested after anti-ICE protests

-

Southern Cameroons Crisis: Norway extends detention of Ayaba Cho

-

Victoria United Vs PWD Bamenda: FECAFOOT suspends five match officials over controversial refereeing

© Cameroon Concord News 2026

16, September 2025

Struggling Camair-Co adds Boeing 737-800 in a $77m fleet renewal drive 0

by soter • Africa, Business, Headline News

Cameroon Airlines Corporation (Camair-Co) has taken delivery of a Boeing 737-800, marking the launch of a five-year expansion plan aimed at transforming the national carrier into a competitive regional airline. The aircraft, leased from Czech operator Smartwings, is the first step in Camair-Co’s 2024–2028 strategy to rebuild and expand its fleet.

The project envisions an initial fleet of 14 aircraft—11 passenger and three cargo planes—before reaching 18 jets by the fifth year, comprising 16 passenger and two cargo planes. Financing is supported by a CFA47 billion ($76.8 million) direct loan from the Development Bank of Central African States (BDEAC).

Fleet Modernization Amid Challenges

Camair-Co currently operates six owned and two leased aircraft, with repeated breakdowns of aging planes causing operational disruptions. The wet lease of the Boeing 737-800 provides immediate reliability while management works to phase in additional aircraft.

“The new aircraft allows us to restore confidence in our existing routes while we prepare for broader expansion, this is about building the foundation for sustainable operations.” said General Manager Jean Christophe Ella Nguema.

The recovery strategy focuses on three key objectives: enhancing competitiveness, improving operational efficiency, and restoring profitability. Executives view short-term leasing as a necessary bridge to long-term modernization, although the higher costs of wet leasing weigh on already fragile finances.

Camair-Co’s network today serves six domestic destinations—Douala, Yaounde, Bafoussam, Garoua, Maroua, and Ngaoundéré—alongside three regional routes to Libreville, Bangui, and N’Djamena. The expansion plan includes resuming suspended regional services and opening new ones, with Douala and Yaounde targeted as transit hubs for Central Africa.

Management hopes to capture some of the regional traffic that currently transits through Addis Ababa, Nairobi, or Lomé. However, competition is intense, as Ethiopian Airlines, Kenya Airways, and ASKY already dominate the skies of Central and West Africa.

Financial Pressures

The expansion highlights both ambition and risk. Camair-Co carries a total debt of CFA 124 billion ($204 million), making it Cameroon’s second most indebted state-owned company. Since its creation in 2006 and operational launch in 2011, the airline has never posted a profit and has relied on repeated government bailouts.

Analysts note that successful African turnarounds—such as Ethiopian Airlines or Air Côte d’Ivoire—required heavy upfront investment. But they caution that Camair-Co must address fundamental operational weaknesses alongside fleet growth to avoid repeating past failures.

Government project documents indicate that the expansion could generate 3,000–4,500 indirect jobs over five years, with benefits extending across aviation services, logistics, and hospitality. New frequencies and additional domestic routes are also expected to improve integration between northern and southern Cameroon, strengthening national cohesion.

The initiative could create opportunities for local aviation professionals, though Camair-Co faces labor tensions. Reports of disputes between pilots and management over pay and working conditions underscore the importance of maintaining workforce stability as the fleet expands.

The wet-lease arrangement offers an immediate boost, but it also increases operating costs. With Camair-Co’s owned aircraft prone to breakdowns, sustainability hinges on the airline’s ability to modernize its core fleet while integrating leased capacity.

“The arrival of the new jet is encouraging, but execution will be decisive,” said one regional aviation consultant. “Expanding routes without fixing fundamentals risks repeating old mistakes.”

Looking Ahead

Management emphasizes that the 737-800’s arrival is only the first milestone in a staged program. Over the next five years, the fleet is expected to grow from 14 to 18 aircraft, encompassing both passenger and cargo segments. Long-haul ambitions remain on the horizon, with Paris identified as a potential route once regional expansion consolidates.

“This isn’t just about adding aircraft, it’s about building an airline Cameroon can be proud of. The real challenge lies in execution.” said Nguema.

As the aircraft begins commercial service, Camair-Co faces a dual test: delivering growth while addressing structural weaknesses. Success would strengthen Cameroon’s regional connectivity and help Douala and Yaounde emerge as aviation hubs. Failure could add to the financial burden of one of Central Africa’s most fragile carriers.

Source: Business in Cameroon