10, June 2025

Global Economy Set for Weakest Run Since 2008 Outside of Recessions 0

Heightened trade tensions and policy uncertainty are expected to drive global growth down this year to its slowest pace since 2008 outside of outright global recessions, according to the World Bank’s latest Global Economic Prospects report. The turmoil has resulted in growth forecasts being cut in nearly 70% of all economies—across all regions and income groups.

Global growth is projected to slow to 2.3 percent in 2025, nearly half a percentage point lower than the rate that had been expected at the start of the year. A global recession is not expected. Nevertheless, if forecasts for the next two years materialize, average global growth in the first seven years of the 2020s will be the slowest of any decade since the 1960s.

“Outside of Asia, the developing world is becoming a development-free zone. said Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice President for Development Economics. “It has been advertising itself for more than a decade. Growth in developing economies has ratcheted down for three decades—from 6 percent annually in the 2000s to 5 percent in the 2010s—to less than 4 percent in the 2020s. That tracks the trajectory of growth in global trade, which has fallen from an average of 5 percent in the 2000s to about 4.5 percent in the 2010s—to less than 3 percent in the 2020s. Investment growth has also slowed, but debt has climbed to record levels.”

Growth is expected to slow in nearly 60 percent of all developing economies this year, averaging 3.8 percent in 2025 before edging up to an average of 3.9 percent over 2026 and 2027. That is more than a percentage point lower than the average of the 2010s. Low-income countries are expected to grow 5.3 percent this year—a downgrade of 0.4 percentage point from the forecast at the start of 2025. Tariff increases and tight labor markets are also exerting upward pressure on global inflation, which, at a projected average of 2.9 percent in 2025, remains above pre-pandemic levels.

Slowing growth will impede developing economies in their efforts to spur job creation, reduce extreme poverty, and close per capita income gaps with advanced economies. Per capita income growth in developing economies is projected to be 2.9 percent in 2025—1.1 percentage points below the average between 2000 and 2019. Assuming developing economies other than China are able to sustain an overall GDP growth of 4 percent—the rate forecast for 2027—it would take them about two decades to return to their pre-pandemic trajectory with respect to economic output.

Global growth could rebound faster than expected if major economies are able to mitigate trade tensions—which would reduce overall policy uncertainty and financial volatility. The analysis finds that if today’s trade disputes were resolved with agreements that halve tariffs relative to their levels in late May, global growth would be 0.2 percentage point stronger on average over the course of 2025 and 2026.

“Emerging-market and developing economies reaped the rewards of trade integration but now find themselves on the frontlines of a global trade conflict,” said M. Ayhan Kose, the World Bank’s Deputy Chief Economist and Director of the Prospects Group. “The smartest way to respond is to redouble efforts on integration with new partners, advance pro-growth reforms, and shore up fiscal resilience to weather the storm. With trade barriers rising and uncertainty mounting, renewed global dialogue and cooperation can chart a more stable and prosperous path forward.”

The report argues that in the face of rising trade barriers, developing economies should seek to liberalize more broadly by pursuing strategic trade and investment partnerships with other economies and diversifying trade—including through regional agreements. Given limited government resources and rising development needs, policymakers should focus on mobilizing domestic revenues, prioritizing fiscal spending for the most vulnerable households, and strengthening fiscal frameworks.

Finally, to accelerate economic growth, countries will need to improve business climates and promote productive employment by equipping workers with the necessary skills and creating the conditions for labor markets to efficiently match workers and firms. Global collaboration will be crucial in supporting the most vulnerable developing economies, including through multilateral interventions, concessional financing, and, for countries embroiled in active conflicts, emergency relief and support.

Source: World Bank

12, June 2025

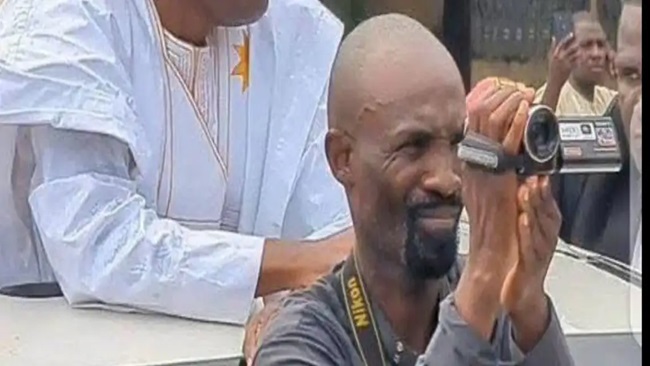

Cameroon ranks third in global Kola Nut production 0

Cameroon’s kola nut production has hovered around 48,500 tons annually over the past five years, accounting for 15.4% of global output. This places the Central African Economic and Monetary Community (CEMAC) economic powerhouse as the world’s third-largest kola nut producer, according to Tridge, an agricultural market intelligence and food product trade platform.

Cameroon trails Nigeria and Côte d’Ivoire, the top two international suppliers of the product. Tridge data indicates that Nigeria, the West African giant, produced 174,100 tonnes in 2022, representing 55.2% of global production. Côte d’Ivoire’s output in 2022 reached 58,640 tonnes, or 18.6% of the world total.

The global top five kola nut producers are completed by two other African nations. Ghana ranks fourth, with a 7.8% market share and 24,643 tonnes produced in 2022. Sierra Leone follows, with 8,450 tonnes during the review period, accounting for 2.7% of the global kola nut market.

Analysts predict that these five market leaders will see increased returns from kola nut cultivation in the coming years due to rising demand. A study published in April 2025 by Cognitive Market Research, cited by Ecofin Agency, estimates the kola nut market to be worth $119 million (approximately 65 billion CFA francs) in 2025. The study projects the market to grow by an average of 3.3% annually through 2033.

This anticipated surge in the global kola nut market is fueled by the diversification of its uses. While traditionally consumed in its raw form across many African countries, market analysts note a growing demand for kola nut in the agri-food industry, cosmetics, and traditional medicine.

Kola nut exports are not explicitly listed in Cameroon’s 2022 and 2023 foreign trade reports, published by the National Institute of Statistics (INS). However, this does not necessarily mean the country has no exports of the product. It is plausible that, similar to other agricultural goods like cotton, cereals, and even cocoa, Cameroonian kola nuts are exported through informal channels to Nigeria, the world’s leading producer. Cameroon shares a long and porous border of approximately 1,500 km with Nigeria.

Despite probable informal exports, as well as local consumption and still-limited artisanal processing, which are the primary uses of kola nut in Cameroon, the forecasted growth in this product presents a significant opportunity for both industry stakeholders and public authorities to better position kola nut on the national and international economic stage.

Source: Business in Cameroon